Ground Realities of Microfinance: Borrower Stories

A few months ago, I had the opportunity to join our investment team on a due diligence (DD) visit to Light Microfinance, a microfinance institution (MFI) headquartered in Ahmedabad, Gujarat in India. MFIs are financial service providers that give out small-ticket loans to borrowers who are otherwise excluded from traditional banking services. The agenda was set; day one of our visit included meetings with the C-suite of the company and day two, a visit to one of the MFI branches located in Kheda district in Gujarat, about an hour’s drive from Ahmedabad.

Joint Liability Groups and Social Collateral in Microfinance

From the MFI branch, the team took us to meet one of the joint liability groups (JLGs) that had recently availed of a loan from the MFI. A JLG is a group of 4 -10 members, often women and typically from the same village, who come together to obtain a loan. By applying as a group, the physical collateral that would have otherwise been a necessary requirement, is replaced with “social collateral”. The members of this social support system are mutually responsible for each other's repayments, thereby encouraging timely loan repayments. In this way, MFIs help underserved communities access credit even in the absence of physical collateral by lending to JLGs.

JLG Members from Hathnouli Village

This JLG consisted of 8 women borrowers, all living in Hathnouli village in Kheda District of Gujarat. The primary occupation of the village residents is agriculture and its related activities. Women are often also engaged in informal jobs like dairy farming, tailoring, and catering among other things. The female literacy rate of the district stands at 75%, almost 10 percentage points lower than that of men from the same district. Sadly, this is not atypical for rural India. While this gap continues to close, there are still several socio-cultural barriers that limit rural women in India from achieving the same levels of education as their male counterparts. This often leads to fewer job opportunities, financial dependency on male relatives and lower financial autonomy within the household. Microfinance has immense potential to address some of these gaps.

First-Time Borrowers and Access to Formal Financial Services

The JLG members that we met were all first-time borrowers of the MFI. We learnt from the management that about 15%-20% of the MFI’s overall client base currently consists of first-time borrowers who have never accessed formal financial services. The management observed that, typically, after the 4th or 5th loan cycle (each loan cycle is usually 24- 27 months), these borrowers can access to traditional and cheaper credit opportunities from banks. This MFI’s impact is undoubtedly significant as it onboards and initiates first time customers onto formal financial services. Their operational model eliminates several entry barriers that a rural, uneducated woman borrower might face in accessing formal credit solutions: most notably, the lack of a credit history and absence of physical collateral. Microfinance helps them make the transition to being ‘bankable’.

Insights into Microfinance in Kheda, Gujarat

Upon our arrival, we were greeted by the 8 cheerful women who graciously welcomed us into their home. Our conversations were almost trilingual; Gujarati and Hindi with some commonly understood English words thrown in. These women together with the local loan officers shared valuable insights on some ground realities of microfinance in Kheda, Gujarat.

Economic Empowerment through Microfinance

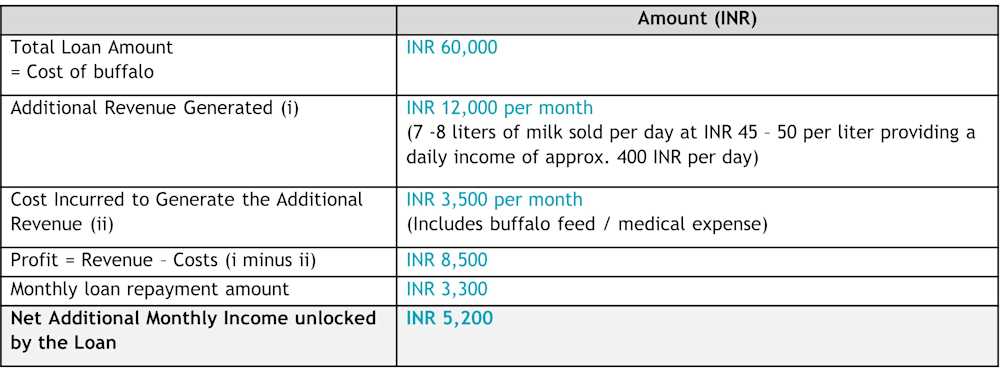

The women used the proceeds of the loan to purchase a buffalo. Given the high penetration of the AMUL milk cooperative in the state, they can sell about 7-8 liters of buffalo milk daily to the nearby AMUL dairy shop, thereby generating an additional revenue stream of INR 12,000 per month, equivalent to USD 145. The monthly loan repayment amount is INR 3,300 resulting in a net additional monthly household income of INR 5,200. While their average household incomes are unknown, it is estimated that the loan enabled an additional income of at least 20% of their total monthly household income and even more once the loan is fully repaid.

Mobile technologies increase efficiency in microfinance operations.

Mobile-based tools are utilized throughout various stages of the investment process. During sourcing for example, field executives verify client information obtained from the field with credit bureau data using an in-house cloud-based mobile application on their smart phones. If any red flags emerge, the loan is promptly declined but can more easily be reevaluated at a later time due to the digitally recorded data.

Similarly, in the due diligence phase, credit managers conduct house visits with potential borrowers and input their observations and client responses directly into the mobile application. This was earlier recorded in a paper-based format. The use of mobile technologies has increased the speed and quality of typical credit assessments of potential borrowers. Additionally, document uploads are facilitated directly through the app, enabling systematic documentation against each loan that is disbursed.

Impact of Microfinance on Financial Management Ability and Resilience

In the case of the JLG members we met, the additional income earned from selling the buffalo milk was directly deposited by the dairy shop into their bank accounts. They now had direct access to these funds, although some of the women lacked experience in withdrawing money from an ATM (Automated Teller Machine). Nonetheless, it was clear to see that the additional income they earned gave them a sense of pride in contributing to their household income. For some, this also meant a greater degree of involvement in household money matters and decision making.

These first hand insights align with the findings of the recent 60Debicels Microfinance Index report which found that clients using Microfinance loans for business purposes showed larger improvements in financial management ability and resilience.

Commitment to Microfinance and Empowering Rural Women

At responsAbility, we will continue to expand our investments in microfinance in emerging markets, a space we have been committed to since our founding in 2003. We have seen the power that microfinance has in reaching people that lack access to financial services. Access to financial services means giving people opportunities to improve their livelihoods, increase their financial resilience and most notably, empower women living in rural areas.

Tanya Philip

Tanya Philip is an Impact Officer with responsAbility Investments. She has authored several research reports and articles around sustainable financing for development and financial inclusion. Her diverse experience covers impact measurement and management, public and private sector advisory, project management, and designing quantitative studies. She holds a Masters in International and Development Economics from Yale University and a Bachelors in Economics from St. Xavier’s College, Mumbai.